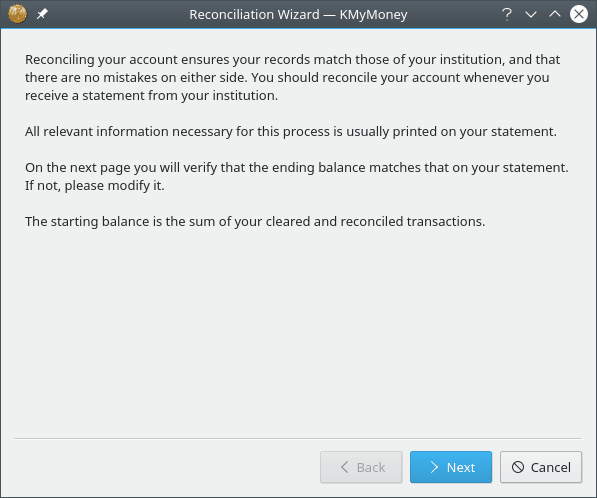

Any of the specified actions will open the reconciliation wizard. The first page of the wizard briefly describes the process you will follow. Click on to actually start the wizard.

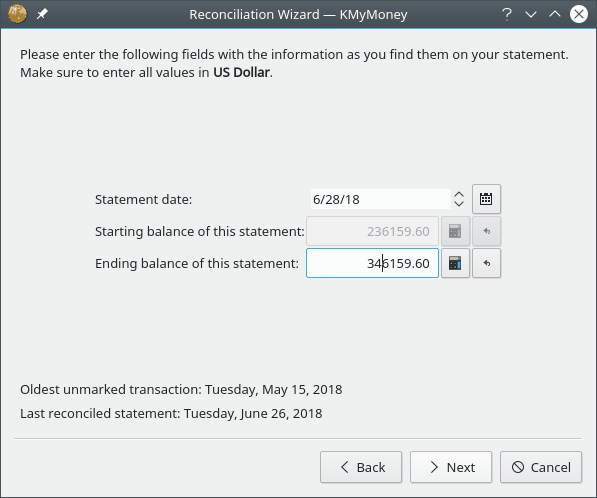

The statement date, starting balance, and ending balance can be found in your statement. The default values displayed by the wizard are determined by your data.

The default value for the statement date is 30 days after the prior reconciliation, so you will often need to adjust this by one or two days. You may need to adjust it by two months if you only receive quarterly statement from the Institution for this Account.

The starting balance shown is the balance on the date of the previous reconciliation. The ending balance is the cleared balance at the end of the Statement date. This is the starting balance with the values of all cleared transactions between the previous reconciliation and the statement date added or subtracted as appropriate.

If the values all match, click on the button.

If the figures do not match there are two paths you can take. The first is to cancel the reconciliation, resolve any discrepancies between your data and the information shown on the statement, and then start the reconciliation again. The second is to adjust the ending balance to match the value on the statement, and then click on the button. You will have an opportunity to resolve any discrepancies during the next step of the reconciliation process.

Note that you cannot adjust the starting balance. If the amount displayed does not match the amount on your statement, it indicates there is a problem with the previous reconciliation, or maybe even an earlier one. In this case, you need to cancel the reconciliation and start again after fixing any problems with your data. The most common reason for this situation is that some time after the prior reconciliation, you have inadvertently edited a transaction prior to that date. There are plans to make KMyMoney more resistant to this problem, but for now, you need to work your way back to find the earliest reconciliation which does match as the problem is most likely with one or more transactions between that date and the prior reconciliation.

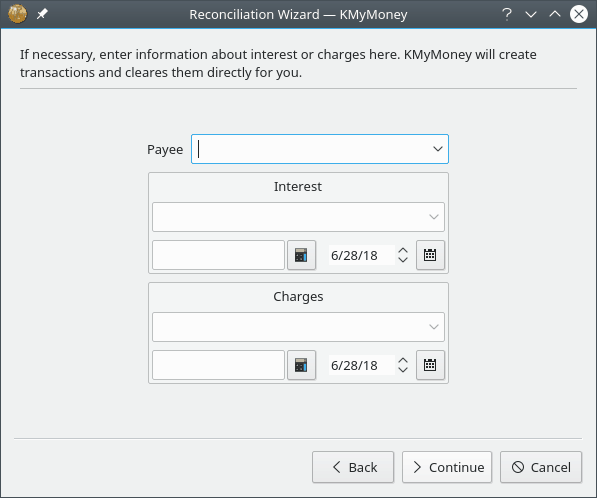

If you are reconciling a bank account or any account which pays interest and/or charges fees, then enter these values in the appropriate fields. Note that both of these fields are optional. If you do fill in one or both of them, a category must be assigned, and the appropriate transaction(s) will be created by KMyMoney prior to the next step of the wizard.

Note

The interest field is for interest you gained. If you have to pay interest, e.g., for a credit card account, this has to be entered as a charge.

Click on to start matching your statement to what you have entered. Note that this is the last screen of the Reconciliation Wizard, but it is not the end of the process of reconciliation. It also changes the ledger display by only showing transactions that have not already been marked as reconciled. As described below, you still need to clear transactions and then tell KMyMoney that the account is reconciled.

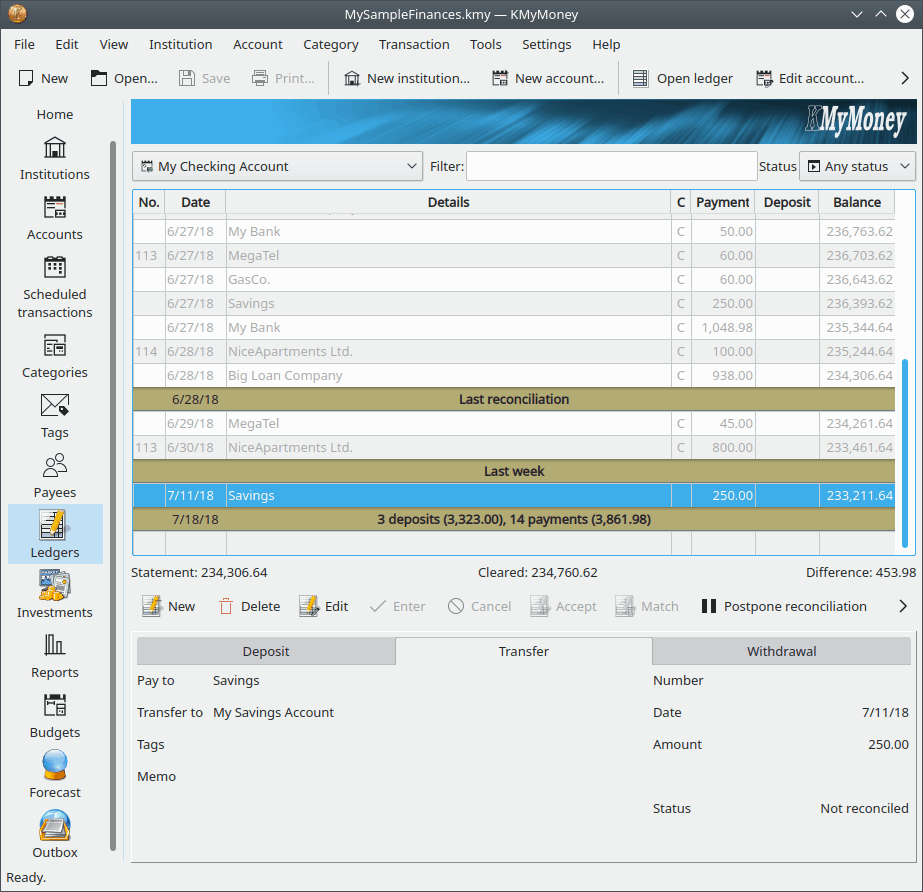

During the reconciliation process, any transaction can be edited to make it match the statement, and new transactions can be created as usual. To mark a transaction as cleared, click on the C column in the ledger. A transaction is cleared when it matches the transaction on your statement.

The command frame (just below the transaction list area) displays the statement amount on the left, the cleared amount in the center, and the difference on the right. As you mark transactions cleared, these values update to show the change.

Note, however, that as reconciliation is the process of matching the data in your account with that on a statement, changes to any transaction with dates after the statement date you entered in the wizard will be saved, but will not have any effect on the cleared amount shown in the command frame.

When the difference between the statement and the cleared balance is zero then the account is reconciled and you can click the button. When you do this, KMyMoney takes all the transactions which have been marked as cleared and marks them as reconciled, and the value in the C column changes from “C” to “R” to reflect the change. In addition, it saves the changes and records that the account has been reconciled. (You still need to save the file to permanently save all the changes.)

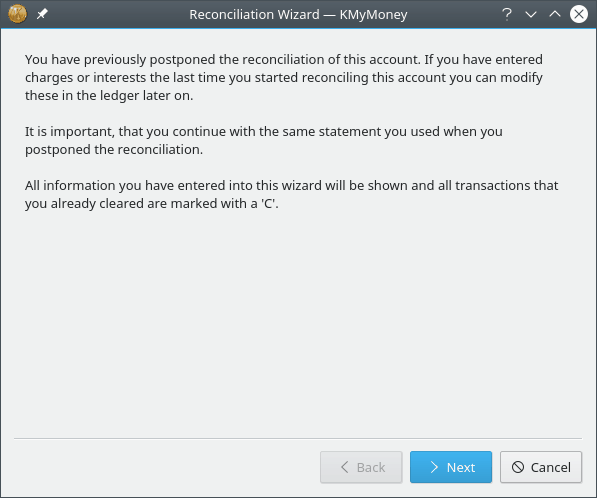

If you are having trouble completing the reconciliation, or you need to gather some additional information before you can complete the process, you can postpone the process to a later time by clicking on the button. When you do this, KMyMoney remembers the values you entered when you started the wizard, it does not mark cleared transactions as reconciled, and it returns the ledger to its normal view. If you exit KMyMoney before clicking either or , it has the same effect as clicking . Any edits you have made, such as marking transactions cleared or entering new transactions, are not touched, and you can still save them before you exit KMyMoney. However, you will have to run the reconciliation wizard again in order to reconcile the account.

When you run the reconciliation wizard on this account the next time, KMyMoney remembers the values you entered when you previously ran the wizard, and you will be able to change them, if necessary. In this case, the initial screen of the wizard is different, to remind you of this.

Although it may change in the future, Investment Accounts currently contain securities, but no cash. Because of this, from KMyMoney's perspective, it makes no sense to reconcile them. However, some users use the reconciliation process to indicate that the number of shares of each security owned matches the Institution's records, whether from a printed statement or indicated on-line. Beyond the number of shares, you could also match the total investment value of each security, which would depend on the last price for that security on or prior to the date of the reconciliation.

If you choose to do this, the process is slightly different from that described above. First, the starting and ending balances will always be 0, as there is no cash in an Investment Account. Next, when you complete the wizard, below the ledger, the statement balance will be shown as 0 and the difference will be the investment value of the account. Finally, after you click the button, you will manually need to change all the transactions marked as Cleared to be Reconciled.