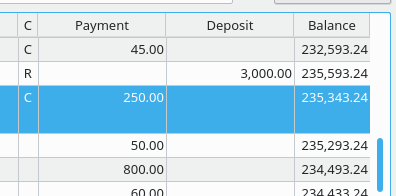

A transaction can have one of three states: non-reconciled (blank), cleared (C), or reconciled (R). When a transaction is entered, it has state of non-reconciled. Once the bank posts the transaction, the user can clear it and thus transform it to state (C). When you receive a statement from the bank, all cleared transactions should be on the statement.

When you reconcile your account, you actually mark the statements as cleared and check that the difference between the beginning balance and the cleared transactions equals the ending balance of the statement. When this is the case, you can 'finish reconciling' which actually changes the state of all cleared transactions (C) to reconciled (R).

If you try to edit a transaction with at least one split marked as reconciled (R), you will be warned.